santa clara property tax rate 2021

Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. Santa Clara County collects on average 067 of a propertys.

Property Tax Calculator Estimator For Real Estate And Homes

The property tax rate in Santa Clara County where Santa Clara is located is 073 or 6650 per year.

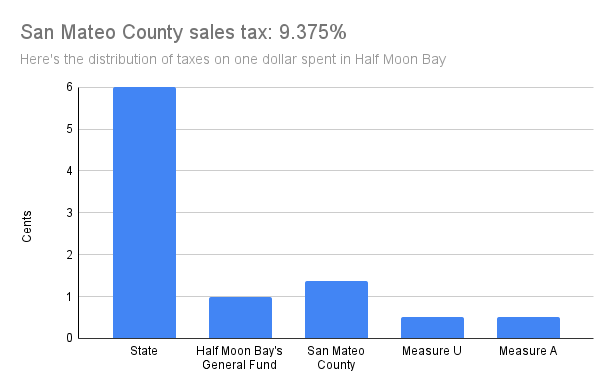

. The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa Clara County sales tax and 2875 Special tax. Every entity sets its individual tax rate. The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

Santa Clara County California. Under a combined tax bill most sub-county entities reach agreement for the county to levy and collect the tax on their behalf. SANTA CLARA COUNTY CALIF.

There is no applicable city tax. Santa Clara County collects on average 067 of a propertys. Real estate and business property values increased by 254 billion In 2021 to a new record high of 5769 billion.

Whether you are already a resident or just considering moving to Santa Clara to live or invest in real estate estimate local property tax rates and learn. The median property tax on a 70100000 house is 736050 in the United States. The fiscal year for Santa Clara County Taxes starts July 1st.

Santa clara property tax rate 2021 Thursday August 4 2022 Edit The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median. According to an annual report from the Assessors office the property values. When added together the property tax load all owners bear is.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus. Unpaid property taxes will become delinquent if not paid by 5 pm. On Monday April 12 2021.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022. Learn all about Santa Clara real estate tax. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

The median property tax also known as real estate tax in Santa Clara County is based on a median home value of and a median effective property tax rate of. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

At that time a 10 percent penalty and a 20 cost will be added to the unpaid balance. Residents of the county can expect to pay an average of 4694 in property taxes each year. TAX RATES The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021.

You can print a. With a total appraised taxable market worth determined a citys budget office can now compute appropriate tax rates.

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

State And Local Sales Tax Rates In 2017 Tax Foundation

Bay Area Property Tax Roll Jumps To 1 8 Trillion Ke Andrews

Santa Clara County Ca Property Tax Calculator Smartasset

Property Assessments Reach 551 5 Billion Peak Of Santa Clara County Economic Growth San Jose Spotlight

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

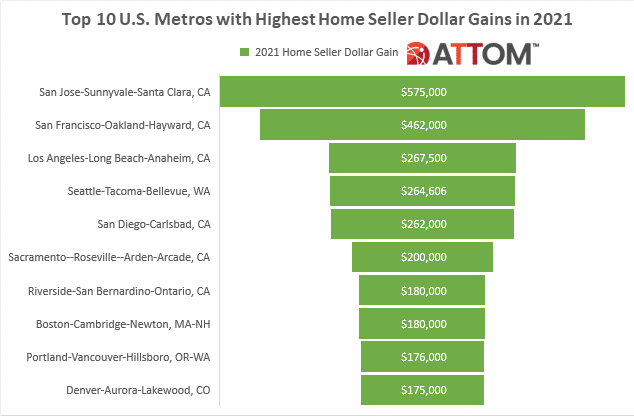

Two Thirds Of Metros Reached Double Digit Price Appreciation In Fourth Quarter Of 2021

Secured Property Taxes Treasurer Tax Collector

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Santa Clara County Home Prices Market Conditions Compass

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County California Ballot Measures Ballotpedia

Prop 19 Property Tax And Transfer Rules To Change In 2021

Top 10 U S Metros With Highest Home Seller Profits In 2021 Attom

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Silicon Valley Property Values Are Soaring San Jose Spotlight